I have to give the good old save my ass clause on this article so where we go. The following information is for informational purposes only. The author does not endorse or encourage the practical use of anything you may read here. The author cannot be held responsible for any losses incurred from acting on any advice you read here.

The USA has some very lax banking rules and favourable rules regarding tax to foreign nationals. In fact America must be the biggest tax haven in the world.

If you are not an American citizen or resident then you cannot open a bank account there unless you have at least $25,000 to deposit in something like a HSCB international account, there are great benefits in this type of account namely being able to hold funds in multiple currencies is very useful. But if you don’t have $25,000 just lying around you don’t have this option.

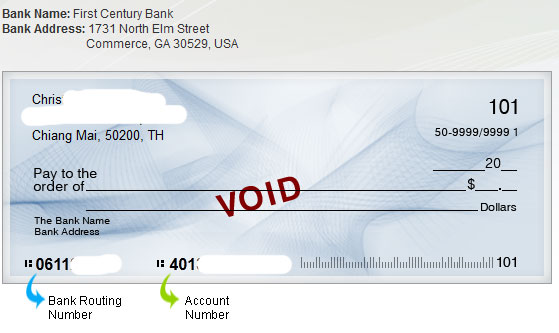

It’s still possible to get a USA bank account well at least in the form of an account number which if you are just receiving money is still very useful.

Just sign up for a Payoneer account, takes about a month to have the card sent to Thailand.

I use Payoneer for little contract jobs it’s just easier for people to transfer to another USA bank account. Places like Amazon and Clickbank make it easy too they just drop the money in there as well. To take the money out does cost a fee but so does a lot of companies who pay to send out checks internationally. If you have money in Paypal and you need it out in a hurry it’s faster to use Payoneer than to do a transfer to a bank in Thailand as well.

Mostly Payoneer is good when you need money faster than traditional transfer methods and still cheaper than say Western Union.

For Example:

If you are getting paid by an American company and don’t live in the USA then you do not have to pay tax to the IRS for that money. Now if you also don’t live in the country named in your passport and are a nomad wondering the globe and your country of origin does not make you pay tax on money you earned while living abroad then you don’t pay tax to your government either. If you don’t pay to the IRS and you don’t pay your own country then who do you pay tax to? No One!

What if you’re american?

As an American you can open a bank account no problems so you might think that this article is not helpful but it still is, if you wanted to hide the income you learned online from the IRS you could manage it easier with the help of Payoneer.

How to hide your activities

If you met a Thai girl anonymously and have them open an account for you either with a bank or Payoneer, Paypal etc, it would be impossible for someone to know how you get money. The person who opens the account for you should not know you at all nor recognize you again, this is probably a better situation as you have access to the account online yet she can’t use it. Doing it this way although illegal it’s possible to hide traces that you actually were getting paid in Thailand or anywhere in the world.